- Home

- Oil Rigs

- Rig Types

- Advertisers

- Desert Rigs

- Oilfield Jobs

- Jobs Offered

- Career Center

- Drilling Ships

- Petroleum Machinery and Equipment

- Oil Exploration

- Crude Oil Price

- Contract Drilling

- Fox Oilfield Services

- Global Marketing

- Overseas Markets

- Oil & Gas Equipment Manufacturers

- Heavy Duty Oil Field Trucks

- Geological & Geophysical and Dry Hole Money

- Oil Drilling Industry Membership Associations

- Government Oil & Gas Projects

- International Oil Exploration

- International Oil Production

- Fox Drilling International

- International Drilling

- Top Job Applicants

- More Top Resumes

- Job Opportunities

- Global Oil News

- Oil Investment

- Photo Gallery

- Resources

- Comments

- Contact Us

- About Us

- Sitemap

- Links

- Jobs

- Oil Tankers

- Oil & Gas Blog

- Oil & Gas Maps

- Oil & Gas Funds

- Arabian Oil & Gas

- Oil & Gas Exploration and Production Resources

- Oil & Gas Resource Links

- An Educational Oil & Gas Resources Guide

- Oil Industry References

- Bloomberg Businessweek

- Tribute to Oil Workers

- Daily News and Views

- Military Support

- Rig Construction

- More Resumes

- Post Your Resume

- Customers

- Rig Fleet

- Related Companies

- Introduce Your Company

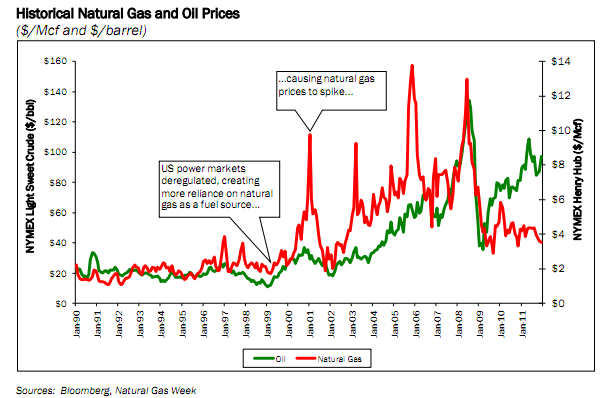

- How to benefit from low natural gas prices

- Gasoline Prices

- Energy Technology Resources

- Resumes One

- Resumes Two

- Resumes Three

- Mining Jobs

- Job Inquiries

- Oil & Gas Bookmarks

- Jackup Rigs

- Drilling Rig Specifications

- Publish Your Resume

- Military Personnel Career & Job Placement Center

- Resume Writing Tips

- Getting A Job

- Show Yourself

- Videos

- Multimedia Page

- Ocean Oil Drilling

- Rigs For Sale

- Job Application

- Drilling Prospects

- Contract Inquiries

- Updated Job Openings

- Companies On Display

- Fox Oil & Gas Superstore

- Media Attention

- Drilling Photos

- Fox Petroleum Machinery Company

- Middle East Oil Drilling

- Oil Jobs

- Petroleum Education and Training

- Sponsors

- Favorite Travel Spots, Foods and Transportation

- Who are you and where's your rig drilling?

- Scholarships

- Announcements

- Directory Listings

- Speaking Engagements

- Friends of Fox Drilling

- Fox Exploration

- Ask Mr. Fox

How to benefit from low

natural gas prices

Big Oil Bets On Natural Gas

Royal Dutch Shell said that by 2012 it expects more than half of its output will be natural gas – not oil. That is as if Starbucks said it expects to sell more tea than coffee.

Yet this prediction is not unusual for Big Oil these days. In fact, most of the big boys are making big bets on natural gas.

Exxon Mobil completed eight projects last year. Seven of them were for natural gas projects – not oil. Of the three scheduled this year, two of them are gas. ConocoPhillips paid $5 billion for Origen, an Australian gas company.

Meanwhile, Chevron hammers away at its mammoth liquefied natural gas plant off the coast of Australia, at a total cost of more than $40 billion. (Liquefied natural gas, or LNG, is easier to transport.) Most of the oil giants are also slamming billion-dollar fistfuls on the table to pick up shale gas acreage in places such as the Marcellus in Appalachia.

This shift creates new opportunities for investors. But before we get to those, let’s try to understand what’s happening.

There are several things at work here. One is that new oil deposits, like pitchers who can hit, are becoming harder to find. They are also costlier. The Kashagan oil field, which was supposed to be a great find in the Caspian Sea, is seven years behind schedule and billions of dollars over budget. Another factor at work is that 90% of the world’s oil reserves are in the hands of national oil companies. They are off-limits for the likes of Exxon and others.

By contrast, natural gas deposits are more plentiful. They are also getting cheaper to develop. The cost to build an offshore LNG terminal is about half of what it was only two years ago. The big LNG plants can be just as expensive as anything in the oil world, but – unlike oil – these projects don’t usually go forward unless there are long-term contracts in hand to support them. Some of these contracts go for 20-year terms. This makes the business more appealing to the majors, who don’t have to sweat the huge ups and downs they endure in the oil markets.

With contracts in hand, the gas business is just one of putting together an Erector Set. As The Economist notes, “The gas business is really an infrastructure business: drill wells, build gas plants, install pipelines and accrue profits.”

But there is more. The world’s use of natural gas is growing faster than its use of oil. The IEA’s guess is that oil consumption grows half a percent a year. Natural gas consumption, by contrast, should rise more than 50% in the next 20 years. Total, the big French oil company, is even more bullish. It estimates that China will use much more natural gas than is commonly assumed. Only a lack of infrastructure keeps China’s appetite for natural gas under wraps. But China is in the process of building that infrastructure today. It is only a matter of time before the nat gas markets feel its impact.

Finally, natural gas is cleaner burning. There is a lot of talk of carbon taxes of one kind or another, not only in the US, but abroad. I believe it is a matter of when, not if, governments punish dirtier fuels. Natural gas will benefit.

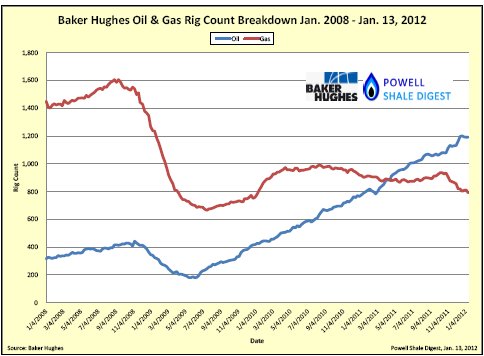

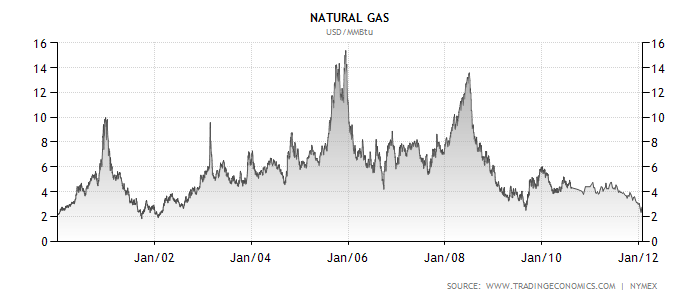

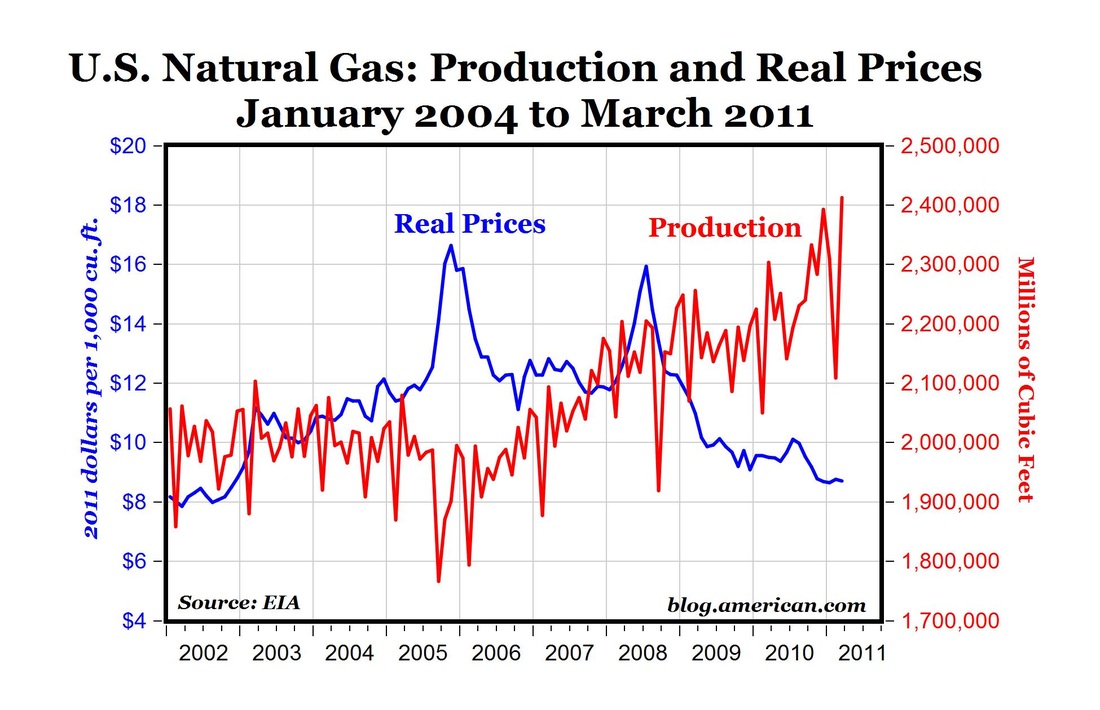

However, I don’t expect the price of natural gas to rise in a big way anytime soon. There is simply too much of it. Natural gas producers are all expanding production. Most are spending more to expand production than their cash flow supports. This is happening even though most look like they don’t make any money at $4 nat gas. (A recent survey put the industry average at $5.74.) This doesn’t bode well for the price of natural gas in the short term. As beaten up as it is, it could stay here for a while, or even go lower.

One of my favorite plays in the natural gas sector remains Contango Oil & Gas (AMEX:MCF [1]). This is because it is a low-cost producer with no debt, so it can still create shareholder value in a low-price environment. Contango’s all-in costs are under $2 for nat gas.

Longer term, the current low nat gas price is not sustainable, as most of the industry seems to lose money at these prices. As old contracts (made when natural gas prices were higher) roll off, these producers will start to shut down production.

At a recent conference, Ken Peak – CEO of Contango and the largest stockholder, with 19% of the shares – shared the following chart, which makes the point. It shows the cost curve for the lower 48 states in the US. This chart shows that these producers need $7 gas to make money. “If this is right,” Peak said, “I believe we will make a lot of money.”

He says this because logic dictates that we should expect the price of nat gas to gravitate toward the cost of the marginal producers. And since Contango’s costs are under $2, it stands to make a lot of money when gas turns around. I know it’s been almost two years and no dice on Contango’s stock price, but I’m content to wait it out (and buy more).

Even at today’s depressed gas prices, Contango’s SEC PV-10 value – think of it as a rough net asset value – is over a billion dollars. With 15.7 million shares out, Contango is worth at least $63 per share. And that’s why it is still a buy.

But let’s get back to natural gas in broad terms. Even though pricing looks unexciting in the near term, demand looks healthy long term. The world will burn more natural gas in cars and buses of the future than it does today. It will burn more natural gas to heat and cool homes than it does today. It will rely more on natural gas to provide electricity.

Long-term investors should treat these things as inevitable. Big Oil certainly is.

Source: The Daily Reckoning

Home

About Us

Oil Rigs

Resumes

Rig Fleet

Rig Types

Oil Maps

Desert Rigs

Oilfield Jobs

Jobs Offered

Drilling Ships

Made in USA

Oil Exploration

Contract Drilling

Oilfield Services

American Greats

American Heroes

Global Marketing

Overseas Markets

Oil & Gas Equipment

Manufacturers

Heavy Duty Oil Field

Trucks

Geological & Geophysical

and Dry Hole Money

Oil Drilling Industry

Membership Associations

Government Oil & Gas Projects

International Oil Exploration

International Oil Production

Fox Drilling International

International Drilling

Charitable Projects

Top Job Applicants

Job Opportunities

Global Oil News

Oil Investment

Photo Gallery

Resources

Favorites

Comments

Contact Us

Sitemap

Links

Jobs

Oil Tankers

Oil & Gas Blog

Oil & Gas Maps

Oil & Gas Funds

Arabian Oil & Gas

Oil & Gas Exploration and

Production Resources

Oil & Gas Resource Links

America's #1

Oil & Gas Resources Guide!

Oil Industry References

Bloomberg Businessweek

Tribute to Oil Workers

Daily News and Views

Military Support

Rig Construction

More Resumes

Customers

Rig Fleet

Post Your Resume

Related Companies

Introduce Your Company

How to benefit from low natural gas prices

Gasoline Prices